Three tiers. One unified approach.

Every engagement begins with a comprehensive assessment to ensure alignment, clarity, and fit before advisory work begins.

Vantage Core Advisors operates as an integrated advisory council, bringing legal, financial, cybersecurity, and marketing expertise together to support Credit Union leadership at the appropriate level.

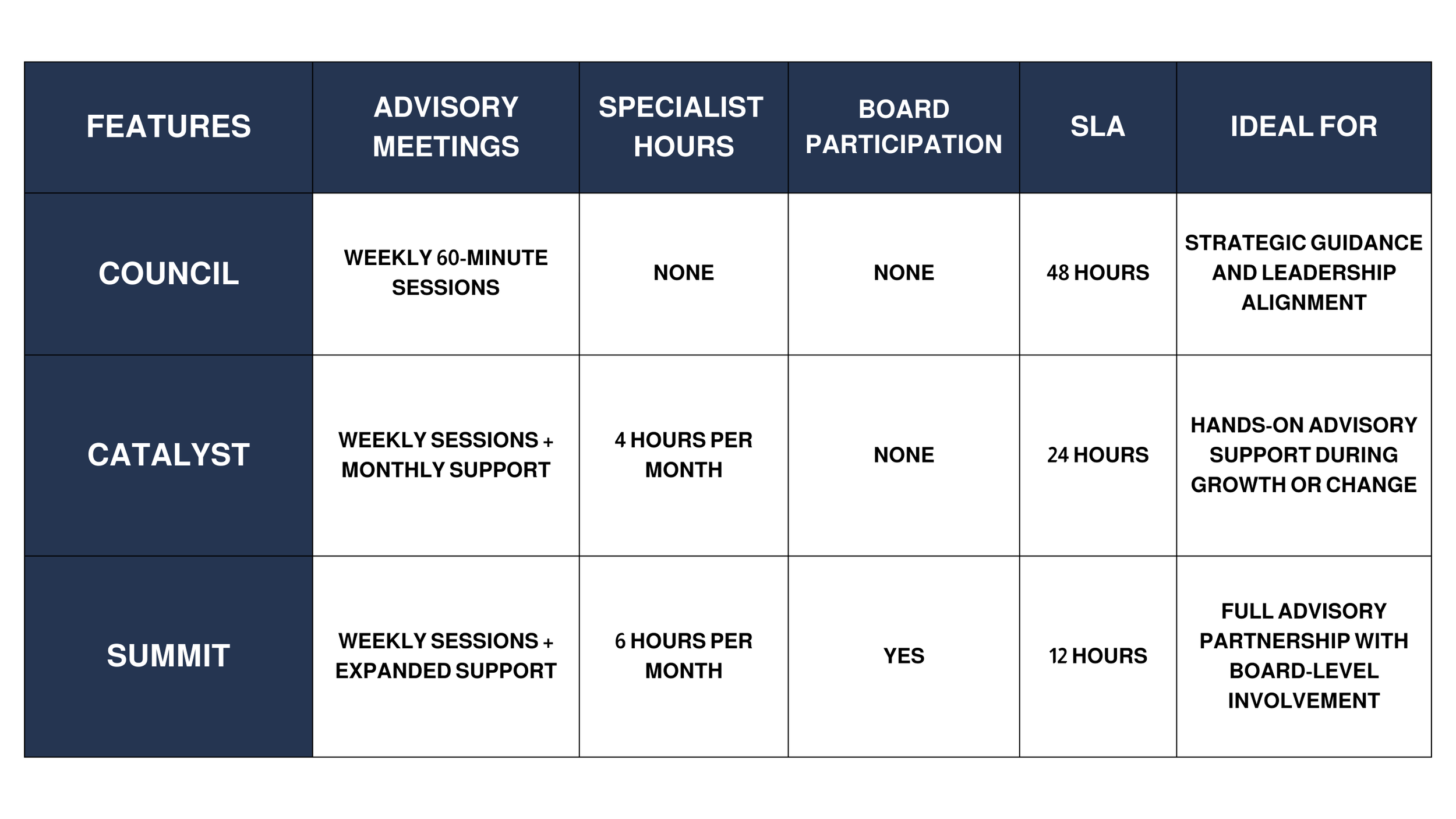

Council

Strategic perspective for Credit Union leadership

Council is designed for organizations seeking consistent, executive-level guidance without day-to-day operational involvement. This tier provides structured advisory support focused on alignment, governance awareness, and long-term stability.

Best suited for leadership teams that value clarity, accountability, and coordinated perspective across disciplines.

Catalyst

Hands-on advisory support for evolving organizations

Catalyst builds on the Council model by adding dedicated specialist hours for deeper analysis and execution support. This tier is ideal for Credit Unions navigating growth, operational change, or increased complexity.

Catalyst provides more frequent touchpoints with subject-matter experts while maintaining a unified advisory approach.

Summit

A full advisory partnership

Summit is the most comprehensive engagement, designed for Credit Unions requiring ongoing executive support, specialist involvement, and board-level participation. This tier supports high-stakes decision-making, governance initiatives, and long-term strategic transformation.

Summit is ideal for organizations facing elevated risk, rapid growth, or complex regulatory and operational demands.

Advisory Engagements at a Glance

How We Work

Every engagement at Vantage Core Advisors follows a structured, repeatable advisory framework designed to give Credit Union leaders clarity, accountability, and confidence at every stage.

The Vantage Core Difference

Most advisory firms operate in silos. We do not.

Vantage Core Advisors delivers integrated, cross-disciplinary guidance so legal, financial, cybersecurity, and marketing decisions are aligned from the start. This collaborative model eliminates blind spots, reduces friction, and gives leadership teams a clearer path forward.

Integrated Expertise

Four advisors working as one council, providing coordinated insight across every critical discipline.

Regulatory Foresight

Deep understanding of Credit Union governance, compliance, and risk so decisions are made with confidence and clarity.

Proactive Strategy

We help you anticipate challenges, not just react to them, through ongoing advisement and structured planning.

Sustainable Growth

Strategies built to protect your foundation while supporting long-term performance, innovation, and member trust.

Start with a 360° Assessment

Every engagement begins with a comprehensive, cross-disciplinary assessment to establish priorities, identify risk, and ensure alignment..